Practical Strategies Payers Can Implement to Reduce G&A Expenses

This is an AArete Healthcare Payer insight

The continued decrease in average star ratings for Medicare Advantage (MA) plans and stubbornly high inflation is serving as a wake-up call to health plans to accelerate efficiency measures to balance operating costs and medical loss ratios, while pricing services competitively. One of the best places to start is looking closer at general and administrative (G&A) expenses where savings can drop straight to the bottom line with no impact on patient care.

In our conversations with health plan leaders, many executives have told us they were caught off guard by the extent of the drop at the top of the star ratings. The primary reason, they said, was the impact of a new statistical methodology (the Tukey outlier deletion technique). Leaders also cited continual challenges with data content and accuracy. Because the Centers for Medicare & Medicaid Services (CMS) is continually changing and enhancing the program, leaders must have a strategy to monitor activities that influence its plans.

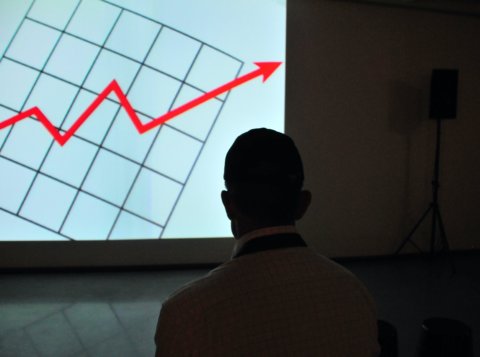

Still, the declines were eye-opening. For the 2024 plan year, CMS awarded 5 stars to 31 plans compared with 57 in 2023 and 74 in 2022. Average scores also dropped to 4.04 versus 4.14 (2023) and 4.37 (2022).

Bonus revenue payments tied to higher star ratings have been a key driver of funding for health plans. Payers earn roughly $45 per member per month in bonuses (before rebates) when their plans earn 4 stars or higher. KFF estimates MA bonus payments will hit $12.8 billion in 2023, up from $3 billion in 2015. That compound annual growth rate (nearly 20%) far exceeded increases in enrollment, which grew 8% during the same period.

The impact of losing a star cannot be understated. The ratings matter because they strike at the heart of a plan’s future sustainability, and its ability to attract and retain members. Consumers generally compare MA plans by looking at costs and benefits. The stars rating indicates how well the plans are performing for members and their satisfaction with the plan. Payers facing lower stars ratings will see a material drop in bonus payments. Plans will not reap the benefits of improvements to quality scores for at least two years. Actions must be taken quickly in other areas of the business, such as G&A expenses, to blunt the impact of lost revenue.

Why the drop in stars ratings matters – and why leaders need to act now

MA plans for 2024 are already set, so revenue projections for calendar 2024 should be reasonably well-known. Health plan leaders also have only a couple of months left to improve 2025 scores. That means the actions organizations take today to increase their plans’ star ratings will not have a positive impact on revenue until 2026.

As a recognized leader in healthcare payer consulting, AArete recommends that organizations move quickly to shrink G&A expenses in areas that do not negatively affect the member experience and patient health. Leaders should take a multi-faceted approach that cuts costs in a transformational way – and resist the temptation to implement unilateral layoffs or one-time budget cuts. These savings are typically not sustainable because the underlying business process, utilization, or service delivery model has not changed.

There are several focus areas that can help drive sustainable value and efficiency improvements for your health plan. One of the best places to start is to get the most out of your vendor partnerships by looking at strategies including:

Vendor contract compliance:

Here is one question to which you should know the answer: Are you 100% sure the fees your organization pays vendors match the prices in the contracts? Our team of experts frequently sees this mistake: Prices paid are higher than what was contracted. Now is the time to review vendor pricing to make sure you are not leaving money on the table.

Vendor pricing structure:

Are the vendor partnerships currently in place structured to solicit outcomes and hold vendors accountable? As a leading consulting firm for health plans, AArete can provide plans with access to the latest market intelligence on pricing so leaders can make informed decisions on the cost and value of the services they are purchasing.

Vendor services:

In addition to reviewing prices, organizations should explore ways to maximize partnerships with third-party service vendors. Is your organization utilizing all the services for which you are paying? Can the vendor provide a cost-saving solution for a particular problem you are facing? You are paying vendors for their expertise, so ask them for help in identifying ways to eliminate unnecessary costs or work.

Leveraging the latest automation technology

After exploring cost-savings possibilities with vendors, organizations should make small, targeted investments in automation technology that can make a meaningful impact in the following areas:

Medical claims processing:

In our work with plans across the country, we have helped clients with process enhancements for claims processing that have led to lasting improvements in productivity and profitability. Mistakes in medical claims processing directly impact the timing, collection, and accuracy of payments. Because claims pass through multiple departments, the margin of error is amplified. Investments in AI-powered tools can help leaders identify problem areas and automate processing so payments flow more accurately and faster.

(For more information about claims and redetermination, check out this Managed Healthcare Executive guest article by Mark O’Hara, AArete managing director and co-leader of our Healthcare Payer Practice.)

Provider authorizations:

Advancements in today’s technology can provide plans with significant opportunities to streamline prior authorization procedures. Customizable software programs – using historical data and powered by machine-learning algorithms – can deliver real-time benefit checking that decreases the amount of time spent processing approvals. Customizable software programs – using historical data and powered by machine-learning algorithms – can deliver real-time benefit checking that decreases the amount of time to process and approve approvals.

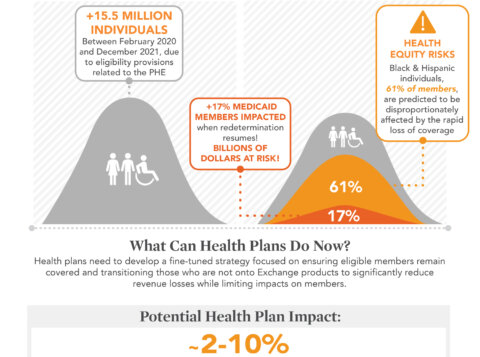

Eligibility reconciliation:

Mistakes in patient eligibility often bedevil health plans, dragging down employee output and adding unnecessary costs. Inaccurate manual data entry can lead to delays in authorization and claims processing. AI-powered software can automate patient registration and verify eligibility and benefits.

Countering unpredictability

Plans are generally unable to predict their MA star ratings because CMS changes to methodology will impact outcomes. So, leaders need to make targeted, meaningful investments in technology to lower G&A costs. Those actions will help protect operating margins, so plans have the necessary capital to invest in services that enhance member care and move the needle on star ratings.

Learn more about AArete’s Digital & Technology solutions.

Request a Demo

If your health plan is seeking actionable, proven strategies to improve productivity and reduce G&A costs, reach out to us today. We are ready to help.