Overcoming PBM Dominance: How Health Plans Can Take Control of Their Pharmacy Benefits

This is an AArete Healthcare Payer insight

The future of pharmacy benefit management is shaped with each passing day, legislative initiative, and industry shift. The escalating and often unpredictable cost of medication continues to be a major concern for consumers, providers, and payers nationwide, driving increased legislative and regulatory focus on the pharmacy benefit manager (PBM) industry. As health plans navigate the complexities of rising drug costs and the dominance of PBMs, they should consider strategies that address immediate concerns while laying a foundation of long-term sustainability for themselves and their members.

Here are eight strategies health plans should consider:

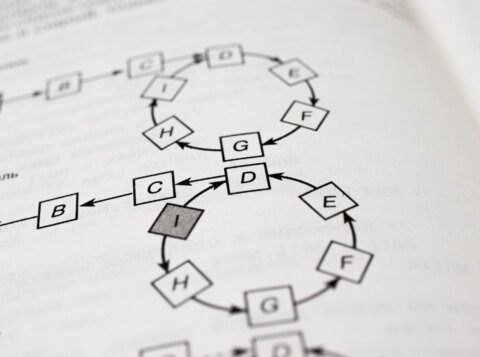

- Partnerships: Strategic affiliation or collaboration with various entities such as pharmacy networks, provider groups, health systems, point solutions, health plans, and accountable care organizations to gain efficiencies and deploy innovative initiatives.

- Pharmacy Networks: Developing innovative networks that enhance the efficiency and quality of pharmacy services, improving outcomes and satisfaction and controlling costs.

- Direct Contracting: Taking on direct contracting for functions traditionally managed by the PBM, such as specialty pharmacy, home delivery, clinical programs, and patient assistance programs, exerts greater control and can enhance the overall value of the plans’ pharmacy program.

- Benefit and Formulary Design: Developing a benefit structure and formulary that aligns clinical and financial goals and optimizes benefit channels.

- Utilization Management: Implement cost-effective, technology-optimized prior authorization, medication management, retrospective DUR programs, and other initiatives to manage drug usage and costs.

- Alternative payment models: Consider drug pricing to optimize the lowest net cost for the member and outcomes-based drug contracts. Employ rebate strategies that align with product value and pass rebates onto consumers.

- Organizational Design: Integration of pharmacy and medical data, as well as pharmacy and medical management teams, supports a holistic member management approach, efficient drug utilization across benefits, and enables cross-departmental collaboration for improved decision-making.

- Technology: Incorporating technology, automation, and artificial intelligence and optimizing tools such as electronic prescribing, pharmacogenomics, clinical decision support, electronic prior authorization, predictive analytics, real-time benefit checks, automated claim review, and more can improve operational efficiency, increase transparency, and lower costs.

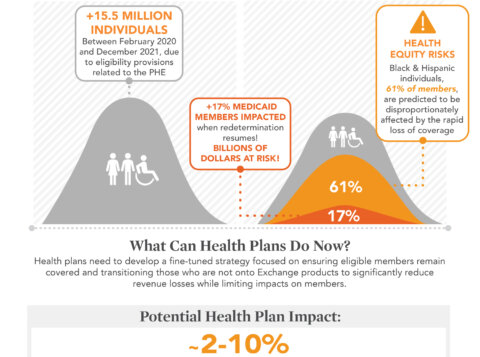

In 2023, pharmaceutical spending in the United States surged by 13.6% from the previous year, reaching $722.5 billion, according to research published in the American Journal of Health-System Pharmacy. This increase resulted from an increase in utilization (6.5%), the introduction of new drugs (4.2%), and price hikes (2.9%).

Health plan member satisfaction remains low, particularly for costs, access to medications, and prior authorization. According to CMS, average star ratings for MA-PD plans have fallen for a second consecutive year, barely reaching 4 Stars.

Meanwhile, according to a widely reported industry survey, health plan satisfaction with their PBM has reached its lowest point in nearly a decade. This dissatisfaction aligns with health plans’ growing interest in transforming the design and administration of drug benefits. Increasingly, progressive health plans are looking for options to improve the member and provider experience and better control drug costs beyond the traditional pharmacy benefit manager-payer model, which has proven inadequate in addressing consumer needs and controlling drug costs.

Health plans will succeed by challenging the status quo and exploring innovative strategies to gain control and distinguish themselves as leaders in centering the member-provider experience.

The Dominance of PBMs

The days when PBMs primarily processed claims are long gone. PBMs have evolved, taking on roles in drug price negotiation and formulary management and gaining extensive control over health plans’ drug benefits under pharmacy and medical benefits.

Simultaneously, three PBMs dominate the marketplace, leaving health plans with fewer alternatives and diminished bargaining power. Their vertical integration with insurance companies, pharmacy chains, and providers and their tightening grasp on specialty pharmacies, rebates, and manufacturer programs have made it harder for health plans to negotiate against or even displace them. Meanwhile, a lack of transparency in PBM operations, especially regarding rebates, forces health plans to prioritize financial incentives over clinical benefits, limiting their ability to deliver quality, affordable care. Without visibility into the true cost of services, health plans face an uphill battle in cost management.

Regulatory Changes and Compliance

The monopolistic nature of the PBM industry and its integration throughout many aspects of healthcare has not gone unnoticed and unchecked. More than 20 federal and 300 state legislative initiatives target the PBM industry. An FTC antitrust probe into PBM practices, launched in 2022, remains ongoing. Upcoming regulatory changes affecting Medicare and Medicaid, such as the Inflation Reduction Act, will also reshape the industry.

By proactively engaging with regulatory changes, health plans can ensure compliance and leverage them to optimize their PBM strategies to prioritize transparency and adaptability. If health plans can effectively adapt to these changes, they will create new avenues for managing drug costs and improving member satisfaction.

Transparency and Operational Control

Transparency in PBM pricing and operations is crucial for informed decision-making and cost management. Health plans should demand detailed reporting and accountability from their PBMs to achieve full transparency. Likewise, they can take a more active role in managing pharmacy benefits with a better understanding of claims processing, rebate management, and formulary structures.

This clarity empowers health plans to develop decision-making strategies to focus on efficiency, cost reduction, and member satisfaction.

The Future Isn’t So Bleak

By adopting some of these strategies, health plans can get ahead of the evolving PBM landscape with agility and agency and even play a role in its evolution by proactively advocating for transparency, integration, and cost-effective drug benefit management while centering member satisfaction and long-term financial stability.

Partners like AArete can provide health plans with the expertise and cross-functional strategies needed to optimize their PBM management and establish themselves as leaders in the healthcare industry.

learn more about AArete’s Pharmacy Solutions.