What is the Business Case for Autonomous Vehicles in the Supply Chain?

In Influencers Roundtable, we bring together voices from consulting firms to share how they perceive various emerging technologies. The answers below have been edited for clarity and length.

Even the Jetsons could not fully imagine a future dominated by autonomous vehicles.

Flying vehicles and robots went hand-in-hand during the animated show. But a world without a driver? Although self-driving cars have been in the popular imagination for decades, the technology has long eluded society.

In the past years, however, we have seen autonomous vehicles emerge in warehouses, factory design plans and highways. The news seems to point to a self-driving world just on the horizon. But is it really, and does that eventuality make sense? To find out, we asked three experts:

What is the business case for autonomous vehicles (AVs) in the supply chain?

Autonomous vehicles have a much more serious and quantifiable impact on supply chain logistics and operations than their potential for transporting people.

The prospect of autonomous cars serving in fleets for personal mobility is the most popular vision for the technology, with more than 50 companies designing autonomous vehicle control software aimed at automating consumer driving.

In practice, however, autonomy already exists and is saving companies money in the supply chain. Rio Tinto is operating more than 80 autonomous mining trucks in Australia. In 2016, on average, each of Rio Tinto’s autonomous haul trucks operated an additional 1,000 hours and at 15% lower load and haul unit cost than conventional haul trucks.

As the technology improves and comes down in cost, businesses will find that moving goods inside of factories and between factories and warehouses makes financial sense. This return-on-investment-based thinking of automation isn’t as sexy as a fleet of 80,000 Waymo cabs picking up passengers around the globe, but it is a more likely future.

Companies such as Einride, in Sweden, believe there is a $1 trillion market for autonomous logistics aimed precisely at this market. That company’s electric truck has begun running pallets on a 10 km stretch between warehouses owned by German logistics company, Schenker, in the Swedish city of Jönköping.

It’s a small step, but it makes business sense, solves a problem and can be easily adapted to any business. Like the mining trucks, the efficacy will be rewarded by more usage.

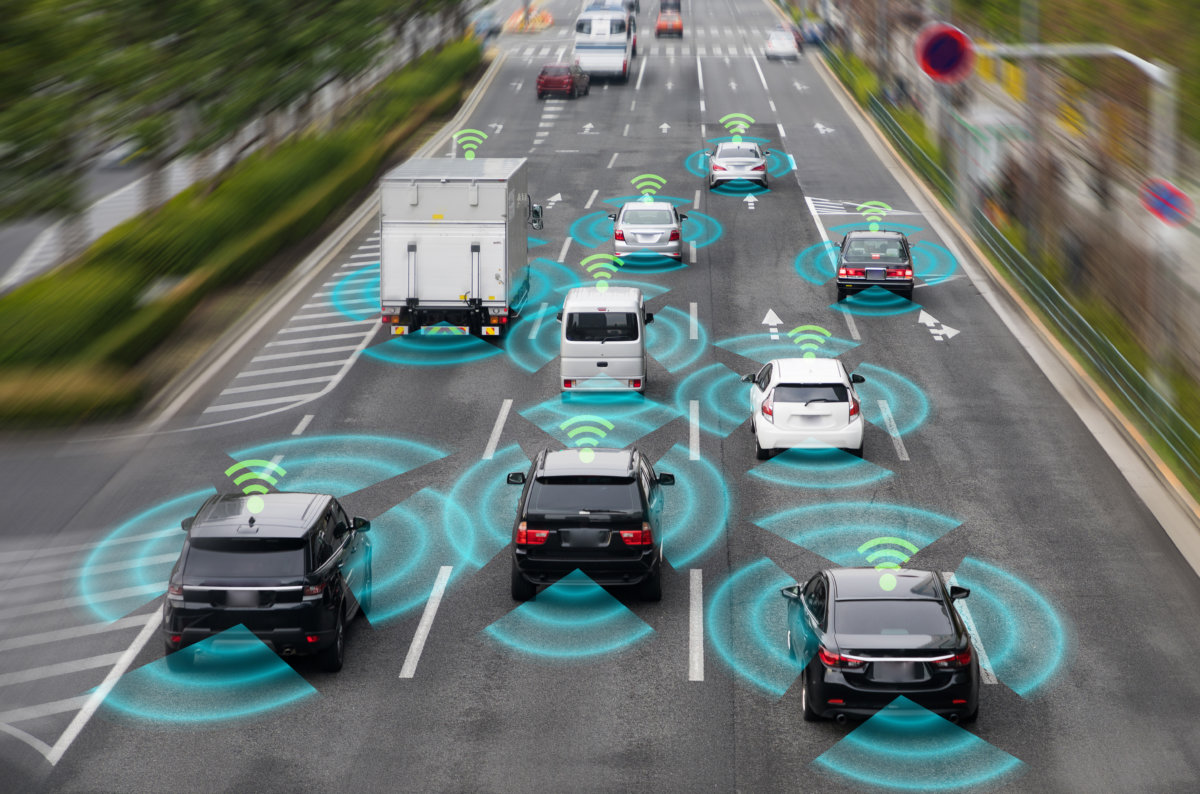

The allure of Autonomous vehicles is clear and understood: To enable self-driving using the latest technology while limiting the need for drivers in an ever-constrained market for drivers.

We have seen numerous tests occurring across companies such as Uber, Google and Mercedes for use in the consumer market, but it’s my belief that being able to make the case for autonomous vehicles in the supply chain is still a long way off.

While yes, technical advancements are being made and the capabilities to apply to commercial use may in fact exist, there are several challenges that will curtail adoption. These include government regulations, legal risk, questions regarding liability and ongoing maintenance of the technology, including resident skill sets within the companies, whether shippers or logistics companies seeking to implement this capability. That’s to name just a few challenges.

The topic raises the question of when to be on the leading edge of technology versus when to be a follower, fast or otherwise.

In this case, I have a hard time seeing the financial and operational benefits associated with early adoption of autonomous vehicles. Are there leading companies that can (and should) experiment? Sure there are. But these companies are few and either have a very fundamental competitive advantage or potentially see their revenue model erode rapidly without this technology – call this the 1%.

For the vast remainder of the companies depending on logistics to move good across their respective supply chains, the 99%, there are many opportunities to extract efficiencies and further optimize current operations through commercially available and proven technology, for example backhaul optimization, carrier visibility and rapid load/unload, that are not even close to being extracted.

With all the bright minds and new technologies entering the arena of logistics we are in a renaissance for the industry and have numerous new capabilities that are proven and open for business to address many of today’s problems. My advice is to start there. Right now, the business case for autonomous vehicles is not ready for prime time.

It’s hard not to hear about some type of disruptive innovation going on in today’s economy, especially in traditional industries like retail, trucking, healthcare or passenger transportation, which have all endured their fair share of radical change lately. With that in mind, the continued expectation is that more disruptions will prevail into the foreseeable future. But some disruptions have been discussed so frequently and for some time, even though they still remain off into the future due to setbacks, delays and the need to fine-tune them.

One such development is autonomous vehicles. When initial mention of autonomous vehicles first broke onto the scene, the reception ranged from pure fascination to thoughts of Knight Rider (the 80’s TV series). But, we’re talking more than just David Hasselhoff and his self-driving KITT car. Indeed, we’re talking about the development and piloting of the current day technology for real-world use.

This, all in spite of the fact that a substantial road ahead remains, especially after the bad press related to Uber’s autonomous vehicle accidents. What’s more, there’s another layer for public and/or governmental approval to allow driverless vehicles to parade our public roads while we go about our business. Casual surveys amongst friends, family and colleagues elicit feelings of uneasiness when discussed as a potential reality.

So, what does this all of this mean for an innovation in the supply chain? Even as big leading companies like Google, Tesla, Amazon, Daimler, Uber Volvo and Rolls Royce continue to pour money into development and testing, nothing has gone full scale operational in the field. Nothing is certain, at this point. In fact, summer of 2018 saw Uber trying to call it quits for its Otto division (Uber’s autonomous truck segment acquired in August 2016).

So is the race really on, or is it that companies (driven by consumers), in general, are afraid to fall back to times when Kodak, Blockbuster or even the flip phone ruled?

It’s more likely that the supply chain world is seeking labor saving alternatives and this may capitalize on technologies to offer a razor thin margin industry a chance to make a dent due to rising wages and driver shortages. Either way, autonomous vehicles in the supply chain still have many more hurdles to clear before anyone gives them room to pass on local roads or highways.