Acquisitions, and More Acquisitions: Navigating VMware Negotiations Amid Organizational Changes

This is an AArete Strategy & Change insight

Broadcom’s recent VMware acquisition stands as another reminder of the tech industry’s shifting nature. The development ushers in a host of changes and challenges for clients: steep pricing increases, licensing model adjustments, and a constrained selection of strategic partners.

These challenges have complicated renewal negotiations and the establishment of new contract terms, with some clients facing potential price increases up to tenfold based on their VMware footprint.

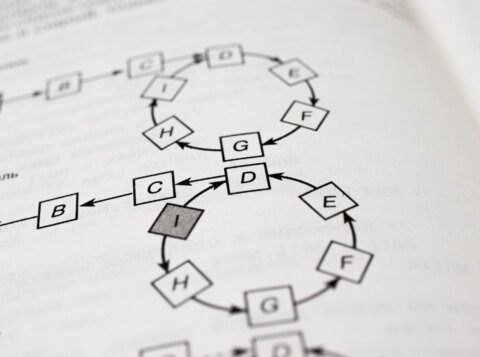

Compounding the complexity, VMware’s End-User Computing (EUC) sector‘s acquisition by KKR from Broadcom has led to variations in contracting processes and support, especially compared to Broadcom’s VMware ESXi sector.

Expert assistance in navigating Broadcom and KKR terms is paramount for clients contending with this layered post-acquisition landscape.

Timing is Everything

In its new form, VMware’s quoting and contracting process is stretched to an extensive three to six months. This elongated process comes with a decline in operational support and an under-resourced business desk, impacting responsiveness and general account management during contract negotiations.

To overcome these hurdles, clients should adopt the following approaches:

- Set clear deadlines for VMware deliverables throughout the quoting and contracting process to hold VMware accountable and prevent potential support and service disruptions. In the event of a delay in deliverables, the client must escalate the contract’s urgency.

- Client Subject Matter Experts should be vigilant of changes to licensing models, such as a shift to subscription models and bundled pricing, to ensure the accuracy of licenses and core count conversions.

- Engage in cross-departmental collaboration to aid in discussions with VMware and comprehend Broadcom’s value proposition and its impact on IT strategy.

- Consolidate contracts and requirements to realize benefits like streamlined contract management, negotiations competitive rates through increased volumes, and co-terming contracts to align renewal dates and scale requirements efficiently.

Contract Considerations

Through proactive communication with VMware, clients can understand the strategic partner program and negotiation channels.

While VMware’s direct purchasing option via Broadcom offers competitive pricing and a direct client-OEM relationship, clients should verify the eligibility of strategic partners — resellers — who supply VMware products. These partners provide pricing and value-added services based on tier levels.

Additionally, clients must be diligent and proactive in confirming the value of the VMware contract in order to mitigate timing risks. The negotiation channel depends on licensing type (EUC vs. ESXi) and spend threshold, which could determine whether redlines and terms are processed through Broadcom or a third-party aggregator like CarahSoft.

Clients may directly contract through Broadcom for more comprehensive commitments, while less intensive agreements necessitate contracting through CarahSoft. Clients may contract through CarahSoft for VMware EUC solutions, or contract directly with KKR for any spend threshold.

Stick the Landing

Navigating the VMware acquisition presents challenges such as depletion of resources, operational constraints, and revised licensing models leading to price hikes.

While cumbersome, challenges experienced post-acquisitions and mergers are not unprecedented; the Cisco acquisitions of Splunk and the TIBCO merger with Citrix also presented clients with operational adjustments, contracting complexities, and increased costs due to changes in resource allocation and licensing models.

In this evolving environment, clients can assure a successful contracting process by understanding what it calls for and employing strategic negotiation processes. AArete’s team of expert consultants is prepared to help clients through this journey.