Medicaid Changes Are Inevitable – How You Prepare Matters

This is an AArete Healthcare Payer solution

With the new administration prioritizing federal spending cuts, Medicaid restructuring has become a key focus, with the intent to change structural components to reduce eligible members and state reimbursement. To achieve $2 trillion in budget cuts, Medicaid will inevitably be affected. Even if proposed federal Medicaid funding reductions—totaling $880 billion over 10 years in House Concurrent Resolution 14—are lowered to $400 billion1, the gradual but significant financial strain will still require states to continually reassess eligibility, reimbursement structures, and care delivery models to maintain program viability.

For health plans, this evolving landscape demands agility, foresight, and proactive strategy—read on to discover how your organization can navigate these shifts effectively.

Medicaid in Flux: Key Risks to Watch and Prepare For

Medicaid expansion faces growing uncertainty, with funding reductions potentially triggering rollbacks in several states. Arizona, Arkansas, Illinois, Indiana, Montana, New Hampshire, North Carolina, Utah, and Virginia have laws that automatically scale back or eliminate expansion if federal support drops below a set threshold—90% in most states and 80% in Arizona. If these funding triggers are met, 3.1 to 3.7 million enrollees could lose coverage2. For health plans in these states, proactive scenario planning, member engagement, and operational agility will be critical in mitigating disruptions.

Beyond expansion rollbacks, Medicaid cost reduction efforts continue to evolve, with potential policy shifts such as state block grants and eligibility changes. Some states are already preparing, while others may need to implement safeguards. Health plans must assess their readiness—adapting operations, strengthening compliance, and refining member engagement strategies—to navigate an unpredictable policy landscape and sustain continuity of care.

Funding Model Shifts: Block Grants, Per Capita Caps, and State Financing Changes

The administration has proposed fixed federal funding allocations through block grants or per capita caps, effectively capping federal expenditures and shifting greater financial risk to the states – particularly during economic downturns or public health crises. While this approach provides states with greater flexibility in Medicaid program design, it also limits the federal government’s financial commitment, forcing states to identify alternative funding sources to sustain their programs.

One method states have used to maximize their federal Medicaid match is provider and insurer taxes, a long-standing financing strategy that some lawmakers argue artificially inflates Medicaid costs. Nearly every state except Alaska currently levies provider taxes to generate the state’s share of Medicaid funding, which in turn draws down additional federal matching dollars. However, proposals under discussion in Congress seek to limit or eliminate these taxes, framing them as a loophole that allows states to increase Medicaid payments with minimal state contribution. Critics of this approach argue that reducing these taxes would force states to make difficult trade-offs, including raising general taxes, cutting Medicaid eligibility or benefits, or shifting more costs onto providers3.

This policy shift could create new financial pressures for health plans, providers, and state Medicaid agencies, particularly in states that rely heavily on provider taxes to sustain Medicaid funding. A proposal to phase down the allowable tax rate from 6% to 3% by 2028 is estimated to reduce federal Medicaid spending by $175 billion over a decade, with full elimination potentially saving $612 billion—a major share of the $880 billion in cuts Congress is considering3.

For health plans, these changes raise significant strategic considerations. The potential loss of federal matching dollars—combined with lower Medicaid reimbursement rates and increased state budget constraints—could translate into greater financial instability, increased cost burdens on commercial lines of business, and further pressure on provider networks3. While widespread adoption of block grants or per capita caps remains uncertain, health plans must be prepared for shifting Medicaid financing rules. Proactively modeling financial exposure, strengthening contingency plans, and advocating for sustainable reimbursement structures will be essential to navigating these evolving funding challenges.

More Services, Less Funding: Operational Shifts for Managed Care Organizations (MCOs)

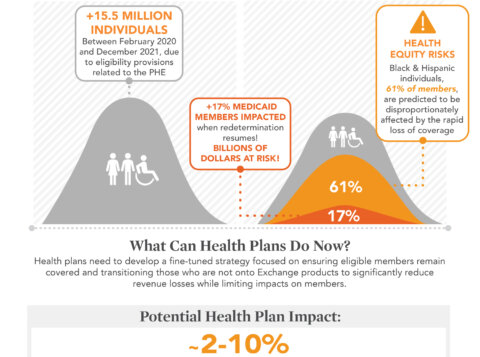

Medicaid policy changes will have significant implications for Managed Care Organizations (MCOs), particularly in expansion states. As of July 2022, 32 of the 39 expansion states relied on MCOs to manage newly eligible adults4. With funding uncertainties growing, MCOs will likely face tighter reimbursement rates, requiring them to offer more services with fewer resources – a challenge exacerbated by recent Medicaid redeterminations, where health plans were absorbing sudden shifts in eligibility and coverage losses.

In addition, commercial lines of business and providers will feel the strain. Lower Medicaid reimbursement rates could squeeze provider margins, leading to network adequacy concerns and access issues. If capitation rates are reduced while MCOs are expected to provide more value-based services, plans will need to balance member engagement, preventative care strategies, and cost containment without compromising quality. At the same time, states may increase pressure on MCOs to expand value-added benefits at the MCO’s own cost as a way to maintain membership, further straining already limited financial resources, or they may consider taxing providers to aid the effort.

These pressures will extend beyond Medicaid, affecting ACA marketplace plans as well. If Medicaid eligibility thresholds are lowered, individuals may be forced into ACA exchange plans with fewer subsidies or higher out-of-pocket costs. This would likely lead to higher churn, lower risk adjustment revenue, and greater instability for commercial insurers causing enrollment volatility, increased administrative complexity and greater financial risk for payers.

To stay ahead, health plans should proactively engage with regulators and policymakers to advocate for sustainable reimbursement models while implementing efficiency-driven solutions such as:

- Expanding value-based care initiatives that reduce long-term costs through preventive and coordinated care.

- Reevaluating provider contract structures to align payment models with new reimbursement realities.

- Enhancing predictive analytics to anticipate membership shifts and cost implications in a changing eligibility landscape.

- Exploring new partnerships or strategic acquisitions to diversify offerings and stabilize revenue streams.

Without strategic planning and adaptive reimbursement models, MCOs and commercial insurers alike will struggle to navigate potential financial and operational challenges ahead.

Eligibility Volatility: Managing Enrollment Uncertainty

As Medicaid eligibility rules continue to evolve, health plans must prepare for significant shifts that could impact enrollment, funding, and care delivery. The reintroduction of work requirements, potential coverage losses for vulnerable populations, and the broader implications for integrated plans all contribute to an unpredictable landscape. Health plans must take a proactive approach to risk management, member support, and strategic business adaptation to mitigate disruptions.

Work Requirements: Policy Shifts and Potential Impacts

Medicaid work requirements have resurfaced as a policy tool to control enrollment growth and reduce federal spending. Recent proposals suggest tying Medicaid eligibility to employment or job-seeking activities, but past implementations have shown mixed results and unintended consequences.

While Section 1115 waivers allow states to impose work requirements, previous efforts faced legal challenges, administrative burdens, and coverage losses. Arkansas was the only state to fully implement work requirements before they were rescinded, leading to 18,000 individuals losing coverage due to non-compliance. A 2023 analysis found that 71% of working-age adults on Medicaid were already employed or enrolled in school full- or part-time. While this suggests that 29% were not working or in school, it does not mean these individuals were at risk of losing coverage, as many qualified for other exemptions beyond disability status4.

Arkansas’s original work requirement policy included exemptions for pregnant individuals, caregivers, those receiving unemployment benefits, individuals participating in addiction treatment programs, and those deemed medically frail or temporarily incapacitated5. These exemptions significantly reduce the population potentially impacted by work requirements, making it difficult to quantify expected Medicaid enrollment reductions or project associated cost savings with certainty.

The difficulty in predicting coverage losses and cost savings is evident in recent state efforts. Georgia’s work requirement program, launched in July 2023, has so far enrolled just 4,231 individuals—far below its 100,000 projection—while 90% of its $26 million budget has gone toward administrative costs rather than medical care6. Meanwhile, Arkansas has submitted a new waiver request to reinstate work requirements, signaling a potential resurgence of these policies despite past challenges.

Navigating these shifts, work requirements introduce not just operational and financial complexities, but also public health considerations. While increased state autonomy may allow for more localized program design, it also requires careful oversight to ensure that eligibility restrictions do not create unintended coverage gaps, disrupt care continuity, or disproportionately affect vulnerable populations. As eligibility policies evolve, health plans must focus on compliance readiness, patient advocacy, and sustainable care models to support both regulatory mandates and member well-being.

Vulnerable Populations: The Greatest Risk of Coverage Loss

One of the most immediate consequences of work requirements is the potential loss of coverage for Medicaid beneficiaries. Some members who become ineligible may seek alternative coverage through the ACA exchange, but if federal funding cuts impact both Medicaid and ACA subsidies, individuals could be left without affordable coverage options.

Integrated plans and those individuals who qualify for them —particularly Dual-Eligible Special Needs Plans (D-SNPs)—face significant risks. Many plans have made growth of D-SNP enrollment a key element of their strategy because of the premium can be double that of a Medicaid member. A reduction in D-SNP eligible members would leave plans with a significantly sicker population requiring more care services. D-SNP members rely on Medicaid for additional benefits like food, housing support, and transportation. Losing Medicaid eligibility could force them into Medicare-only coverage, stripping them of essential support services and making them a higher-risk population for health plans.

For health plans, these shifts present both risks and opportunities—understanding how eligibility volatility affects key populations will be essential for developing retention strategies and adapting product offerings.

Medicaid’s Evolving Future—Proactive Planning is Critical

With millions of enrollees at risk of losing coverage and states facing difficult decisions on cost management, health plans must take proactive steps to assess risks, refine strategies, and collaborate with policymakers to navigate these changes.

Key Steps for Health Plans:

- Model financial and operational risks through “what-if” scenarios to anticipate administrative cost increases and shift spending to variable costs.

- Analyze the impact on D-SNP populations, assessing potential membership losses, revenue impacts, and care management strategies for remaining enrollees.

- Develop a communication and support plan to help members transition to other coverage options while retaining as many as possible.

- Plan for 2026 enrollment, ensuring that product offerings remain competitive for members who may need new coverage options.

- Ensure as much administrative cost as possible is variable, as opposed to fixed, expense so the costs wind down if membership declines.

- Explore mergers, acquisitions (M&A), or new partnerships to expand plan options and meet evolving market demands.

While much remains uncertain, staying informed, engaged, and prepared will be key to mitigating disruption and ensuring continued access to care. Now is the time for health plans to sharpen their focus, assess potential impacts, and take decisive action to adapt to the evolving Medicaid landscape.

References

1 Kaiser Family Foundation. (n.d.). The math is conclusive: Major Medicaid cuts are the only way to meet House budget resolution requirements. Retrieved from https://www.kff.org/quick-take/the-math-is-conclusive-major-medicaid-cuts-are-the-only-way-to-meet-house-budget-resolution-requirements/

2 Kaiser Family Foundation. (n.d.). Status of state Medicaid expansion decisions. Retrieved from https://www.kff.org/status-of-state-medicaid-expansion-decisions/

3 Politico. (2025, February 27). Republicans see Medicaid provider taxes as a way to fill budget shortfall. Retrieved from https://www.politico.com/news/2025/02/27/republicans-medicaid-plan-00206540

4 Kaiser Family Foundation. (n.d.). 10 things to know about Medicaid managed care. Retrieved from https://www.kff.org/medicaid/issue-brief/10-things-to-know-about-medicaid-managed-care/

5 Commonwealth Fund. (2025, January). Work requirements for Medicaid enrollees. Retrieved from https://www.commonwealthfund.org/publications/explainer/2025/jan/work-requirements-for-medicaid-enrollees

6 Medicaid and CHIP Payment and Access Commission (MACPAC). (2019). Medicaid Work and Community Engagement Requirements. Retrieved from https://www.macpac.gov/wp-content/uploads/2019/10/Medicaid-Work-and-Community-Engagement-Requirements.pdf